The fixed overhead expenditure variance helps managers understand why there are differences between what was planned during the budgeting process and what was actually incurred during the period. However, if a company is experiencing rapid changes in its production systems, it may need to revise its overhead allocation rate more frequently, say monthly. If sales on a product are seasonal, production volumes on a monthly basis can fluctuate. By contrast, efficiency variance measures efficiency in the use of the factory (e.g., machine hours employed in costing overheads to the products). Total overhead cost variance can be subdivided into budget or spending variance and efficiency variance. If 8,000 units are produced and each requires one direct labor hour, there would be 8,000 standard hours.

Get in Touch With a Financial Advisor

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- As fixed costs are not absorbed under marginal costing system, fixed overhead volume variance (and its sub-variances) are to be calculated only when absorption costing is applied.

- If the amount applied to the good output is greater than the budgeted amount of fixed manufacturing overhead, the fixed manufacturing overhead volume variance is favorable.

- Let’s also assume that the actual fixed manufacturing overhead costs for the year are $8,700.

- Actual production volume is the production that the company actually achieves (in hours) or produces (in units) during the period.

It helps them understand the impact of changes in the production level on the fixed overhead costs, which in turn helps make informed decisions. It helps companies to identify the expected fixed overhead costs for 2011 taxes to 2021 taxes a given level of production, which in turn helps in setting budgets and making informed decisions. In short, this variance is used as a balancing exercise when fixed overhead expenditure variance is calculated.

Comparison of Fixed and Variable Overhead Variances

When the actual amount budgeted for fixed overhead costs based on production volume differs from the figure that is eventually absorbed, fixed overhead volume variance occurs. The fixed factory overhead volume variance is the difference between the budgeted fixed overhead at normal capacity and the standard fixed overhead for the actual units produced. On the other hand, if the budgeted fixed overhead cost is bigger instead, the result will be unfavorable fixed overhead volume variance. This means that the actual production volume is lower than the planned or scheduled production.

What are two types of overhead cost variances?

Companies typically establish a standard fixed manufacturing overhead rate prior to the start of the year and then use that rate for the entire year. Let’s assume it is December 2022 and DenimWorks is developing the standard fixed manufacturing overhead rate for use in 2023. As mentioned above, we will assign the fixed manufacturing overhead on the basis of direct labor hours. Fixed overhead volume variance serves as a diagnostic tool within financial analysis, enabling organizations to gauge the efficiency of their production processes in relation to their fixed costs. This metric is particularly useful for management accountants who are tasked with monitoring internal cost controls and operational performance.

Accounting Ratios

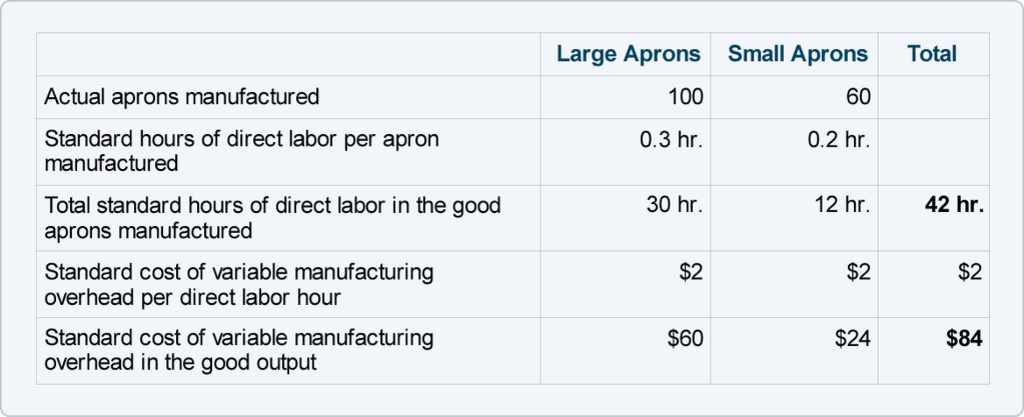

It allows financial analysts to isolate the impact of production volume changes from other variances such as material or labor, providing a clearer picture of operational performance. This distinction is important for managers who need to make informed decisions about resource allocation, budget adjustments, and process improvements. Explore the significance of fixed overhead volume variance in shaping financial strategies and enhancing business planning efficiency. Using the information given below, compute the fixed overhead cost, expenditure, and volume variances. The variance can either be caused by a difference in the fixed overheads at a given level of activity or because of a difference in the number of units produced (which affects the absorption of the overheads). The $5 fixed rate plus the $7 variable rate equals the $12 total factory overhead rate per direct labor hour.

Would you prefer to work with a financial professional remotely or in-person?

This example provides an opportunity to practice calculating the overhead variances that have been analyzed up to this point. Further analysis might reveal that the positive variance is a symptom of larger issues such as suboptimal sales forecasting or marketing misalignment. Conversely, a negative variance, which points to higher than expected production levels, could signal market share growth or an unexpected surge in demand.

The traditional calculation of sub-variances (i.e. fixed overhead capacity and efficiency variances) does not provide a meaningful analysis of fixed production overheads. Because they are fixed within a certain range of activity, these overhead costs are fairly easy to predict. This simplicity of prediction sees some businesses create a fixed overhead allocation rate that is used throughout the year. The allocation rate is the expected monthly amount of fixed overhead costs divided by the number of units produced. Fixed overhead volume variance is positive when the applied fixed overheads exceed budgeted fixed overheads.

We will discuss how to report the balances in the variance accounts under the heading What To Do With Variance Amounts.

(c) In addition, prepare a reconciliation statement for the standard fixed expenses worked out at a standard fixed overhead rate and actual fixed overhead. The fixed overhead costs included in this variance tend to be only those incurred during the production process, such as factory rent, equipment depreciation, staff salaries, insurance of facilities and utility fees. Fixed overhead variance refers to the difference between the actual fixed production overheads and the absorbed fixed production overheads over a period of time. Fixed overhead capacity variance is the difference between budgeted (planned) hours of work and the actual hours worked, multiplied by the standard absorption rate per hour. The total factory overhead rate of $12 per direct labor hour may then be broken out into variable and fixed factory overhead rates, as follows.

It is the normal capacity that the company or the existing facility can achieve for the period. This figure is usually included in the budget of production that is planned or scheduled before the production starts. If you’re interested in finding out more about fixed overhead volume variance, then get in touch with the financial experts at GoCardless. Budget or spending variance is the difference between the budget and the actual cost for the actual hours of operation. This variance can be compared to the price and quantity variance developed for direct materials and direct labor. We indicated above that the fixed manufacturing overhead costs are the rents of $700 per month, or $8,400 for the year 2023.

Fixed overhead volume variance is defined as the difference between the budgeted fixed overhead and the fixed overhead applied to actual output. This variance arises when there is a discrepancy between the actual number of units produced and the number expected to be produced at a given level of fixed overhead costs. If the fixed overhead cost applied to the actual production using the standard fixed overhead rate is bigger than the budgeted fixed overhead cost, the fixed overhead volume variance is the favorable one. This means that the company’s actual production volume measured in units or hours during the period is more than the budgeted production volume that the company has previously planned.